New National procurement which will impact on future contracting across the NHS

Across the NHS, there is a desire to adopt best in class products, take up innovation relating to clinical technology and pathway enhancements, improve the experience and delivery of care to patients, reduce variation in outcomes and most importantly, to improve the working practices and environment for theatre teams across the country.

The operational burden of orthopaedic surgery, options in terms of product selection and the variety of services and solutions on the market, means that contracting functions need to have the strategic ambitions of your department in mind. As the NHS landscape in England changes, there is a need to adopt solutions which bring benefits across the ICS system and which can help to facilitate world leading orthopaedic services to patients within those ICS communities. Of course, this is amidst a backdrop of sustained inflation and a multitude of geopolitical pressures which impact supply chains.

Strategic sourcing is what NHS procurement looks to achieve and the contracts which stem from this activity can have a real impact on the operational effectiveness of the end-to-end patient pathway. As such we believe there is a need for all clinical teams to understand the risks, benefits and opportunities associated with strategic contracting and to be more knowledgeable, not only about the importance of contract compliance, but also about what options are available to you.

The Total Orthopaedic Solutions (TOS) project started in 2015, following which there have been two further iterations of the TOS framework agreements. Since its conception, the NHS Supply Chain specialist regional teams have worked with Orthopaedic and Spine departments across England to deliver significant efficiencies. These include substantial savings on the prices of product across the NHS in England, significant investment in capital and various operational efficiencies observed through a clinically engaged approach to standardisation on procedures. Currently over 90% of expenditure on orthopaedic, trauma and spine products are purchased via contracts under the TOS2 framework agreement and the work conducted under TOS has led to well established norms across Industry and the NHS in England.

In February 2024 the third iteration of the Framework Agreement (TOS3) will go live and will continue to allow surgeons to take up multi-year contracts with industry until 2028. Framework agreements are typically awarded under various lots and NHS trusts can contract for products or services which are submitted by suppliers under those lots. TOS3 will cover all implants and consumables used in all subspecialties, equipment from power tools to robotics and navigation, and dedicated services and solutions. These include an array of options from post-op wearables and VR/AR technology to software solutions and patient pathway programs. (A list of the full TOS3 lotting structure and what is captured is at the end of this article).

The key foundations of our working practices are:

- Clinical engagement – Clinical teams are at the heart of the decision-making process and the subsequent contracts.

- Commercial excellence – Supplier offers are in response to our comprehensive commercial structure via tender, this establishes their national offering, and we maintain transparency across the NHS by removing bespoke offers to individual NHS Trusts.

- Contracting that is fit for practice – Multi-year contracts through proper engagement and consideration for your future practice, we look to establish meaningful commitments between NHS trusts and suppliers, ensuring clinical teams and patient needs are met.

Affecting product price is only one of multiple possible outputs from orthopaedic procurement activity. When considering upcoming contracts, there is an opportunity for clinicians to review overall ambitions for the department and to see if there are solutions from the market which may help to realise or contribute to those ambitions. By reviewing full budgetary spend, we can work with you to maximise on how that budget performs for you, allowing for NHS fiscal responsibility but also determining how money released from initiatives can be reinvested or allocated in a way which improves the overall service.

More and more we are seeing the need and benefit from contracting to be across an ICS. Contracts which enable full and proper elective recovery, and which give consideration to where operations will take place in the future. The work to do this begins several months before the end of your current contract. By being part of the conversation, we can look to impact and contract for a wide range of service objectives such as those below (which can come from the supply base or third parties):

- Post-op monitoring and reporting – e.g. Patient apps/wearables, PROMs data collection, reducing outpatient appointments.

- Operational investment – e.g. Clinical support, inventory management, theatre planning.

- Efficiency Programs – e.g. Patient pathway and/or theatre optimisation programs, elective day case programs.

- Enabling technology – e.g. Virtual / Augmented Reality training an in-theatre applications, remote clinical support technology, imaging and navigation, robotics.

By being part of the conversation at a national level, and by continually engaging on these matters with clinicians and industry, we are well placed to furnish clinicians with the options and details that they need to make informed decisions and ultimately impact on the care being delivered to patients.

Since 2015 we have observed benefits to departments who have standardised on the products they use in theatres, particularly with regards to the improvements in overall clinical support from theatre teams. For example, scrubbing and running for a common supplier brand for a given procedure as opposed to having multiple brands for a procedure type. This positive clinical impact from rationalisation at Trust level ensures that the complexities of supporting orthopaedic case are not made more complicated by holding multiple supplier brands for each procedure – each with different stock holdings and variations on a surgical technique. This uniform understanding across the theatre team extends further when contracting across an ICS, it provides greater resilience as it allows for the mobilisation of that knowledge in times of stress.

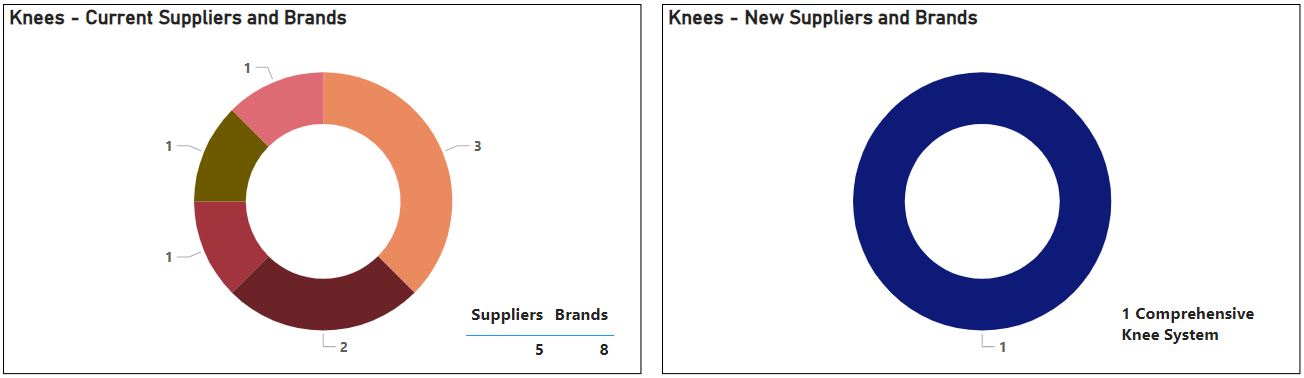

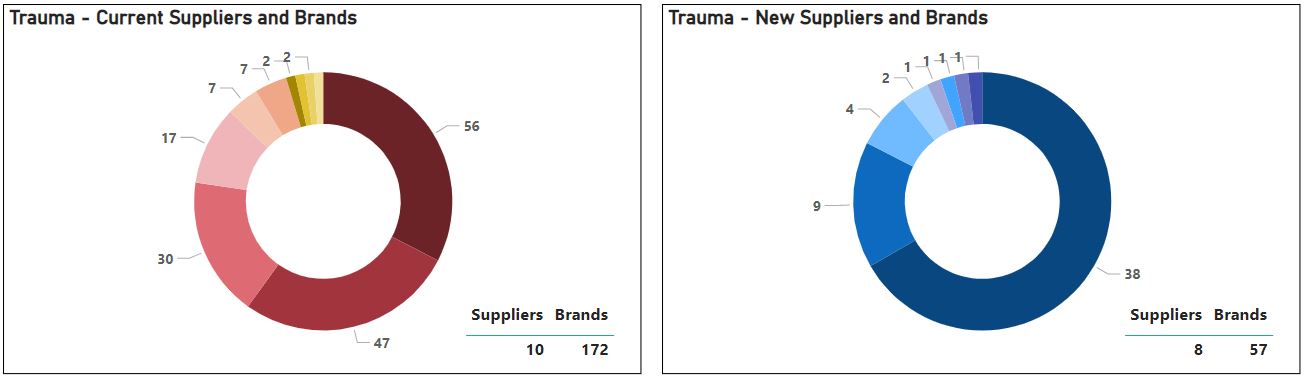

The graphs below show the impact of such ICS projects in trauma and orthopaedics. Given our collective understanding of these medical devices, the consignment stock required for each and the instrument platforms which are needed for them; this is an impact which has real benefits to a theatre team and to also benefits in peer-to-peer product awareness amongst surgeon colleagues.

- For each section (hips arthroplasty, knee arthroplasty and trauma), the different colour segment represents an individual supplier, and the number highlights the number of supplier brands used.

- Each set of charts are a before and after view following a full clinically engaged review of products at the Trust.

Hip arthroplasty – 6 suppliers and 39 brands to 2 suppliers and 19 brands.

Knee arthroplasty – 5 suppliers and 8 brands to 1 supplier and 1 brand (single system).

Trauma - 10 suppliers and 172 brands to 8 suppliers and 57 brands.

Across all activity and through clinical consensus there was a reduction from 281 to 89 supplier brands held on the shelf, a reduction of 31,000 individual product codes and a saving of over £1.5 million on annual implant spend. It also allowed for a refresh in terms of what stock is needed across the ICS – this activity improves the overall profitability of the department and is a better return on investment for industry.

As we move into 2024, we want to establish a wider national conversation with surgeons and theatre teams from across the NHS to continue and capture benefits beyond the price of products. Identifying what meaningful value these contracts can deliver. We are working to establish nationally agreed metrics which will allow us to contract in ways which not only recognise financial impact but those which affect qualitative improvements for our staff, for the patient and also quantitative improvements for the NHS.

This moves us to an era of Value Based Healthcare, facilitated through Value Based Procurement (VBP). We collectively have a responsibility to review how public money is spent and how this can be directed in a way which brings improved social value and sustainability, not only at a national level but also locally, under contract. There are multiple products, services and solutions from across the market which help us on our way to realising these benefits. Focussing on product price alone misses a wider opportunity.

There is ongoing debate and availability of grand solutions from across the market, such as the use of robotic or navigation assisted surgery. But solutions can focus on individual subtle innovations or by adopting non-product specific technology. Product examples in this space would include:

- Something a simple as using a rotator cuff repair kit as opposed to purchasing multiple single items which would be individually packaged; or

- Using anti-infective or antibiotic coated tibial nails for open fracture tibias, to reduce the risk of infection and subsequent patient complications and treatment costs.

- Technological solutions such as patient pathway/post-op apps can allow for earlier discharge, PROMs data recovery, messaging services and a reduction in outpatient appointments but also improved response for patients who may develop unforeseen issues.

- Adopting Virtual Reality to aid training or Augmented Reality technology to support surgery through remote assistance; or giving field of view access to pre-op plans. Innovation in AR looks set to possibly have a wide range of benefits to theatre teams.

Through engaging more widely across the landscape, we can also bring in third party options for review, such as liaising with the Royal Osteoporosis Society to assess the feasibility and impact of establishing Fracture Liaison Services as part of the discussion on trauma standardisation.

These benefits are tangible, can be applied to the adoption of technology and can help the department realise real value in terms of overall cost, workforce improvements and environmental objectives.

Our seven regional teams benefit from a comprehensive understanding of supplier offers to the NHS and we have a dedicated Clinical Engagement & Implementation Manager (CEIM) in each region. Our CEIMs are dedicated orthopaedic professionals; clinicians holding many years’ experience in orthopaedic theatres as scrub and first assistants or from the orthopaedic industry as product specialists. This lived clinical experience alongside their work under NHS Supply Chain with multiple NHS Trusts over the last few years, makes them an invaluable resource to the NHS in ensuring that procurement processes focus on the needs of the clinicians and patients at a local level, whilst being part of the national conversation. The team are well connected daily with your procurement teams and regional representatives from across industry. The regional teams have visibility as to what contracts are in place and they manage a comprehensive work plan with each Trust in their region.

This strategic procurement activity is an important vehicle on the journey towards operational value and efficiencies. The subsequent contracts which are put in place can help us realise that value, but conducted in isolation from broader clinical planning, they can also be an unnecessary blocker.

Each of our regional team members are available to discuss this further with you.

The NHS Supply Chain website gives more information on the current TOS2 framework and in due course will be updated for TOS3.

Please see a more detailed breakdown of what is covered in the Total Orthopaedic Solutions 3 framework agreement.

TOS3 will cover the following:

- Lot 1 – Implants and consumables:

- 1.1 Hip arthroplasty

- 1.2 Knee arthroplasty

- 1.3 Extremities arthroplasty

- 1.4 Complex arthroplasty

- 1.5 Internal and external fixation

- 1.6 Spine

- 1.7 Arthroscopy and fluid management

- 1.8 Bone preparation

- 1.9 Power tool consumables

- 1.10 Regenerative technology

- 1.11 Orthopaedic additional devices

- 1.12 Custom and customisable implants

- Lot 2 – Equipment:

- Includes but not limited to - robotics, navigation, imaging, fluid management, consoles and stack systems, power tools, helmets (hoods/togas), tourniquet machines, bone harvesting/milling, ultrasound cement removal, cement mixing, ultrasound bone healing.

- Lot 3 – Services and solutions:

- Includes but not limited to - wearable devices, software, efficiency programmes, patient/surgeon applications, patient planning, managed equipment services, technical support.

Khalid Shihadah

National Clinical Engagement & Implementation Manager

Orthopaedics, Trauma & Spine; and Ophthalmology

NHS Supply Chain

Mobile: 07825011436

Email: [email protected]